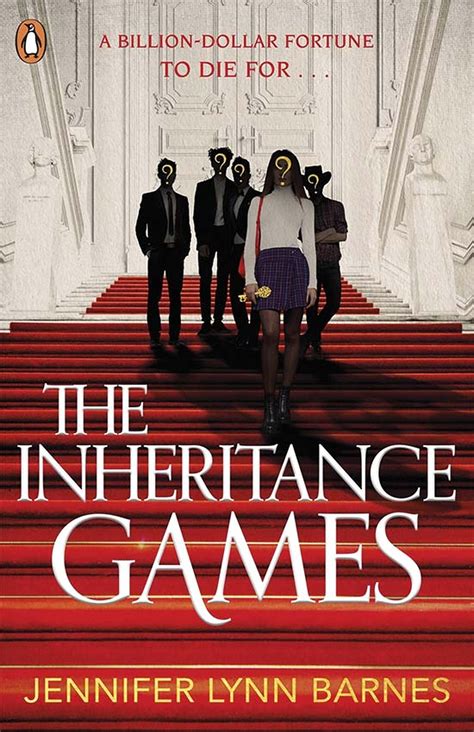

The world of estate planning and inheritance is complex, with laws and regulations varying significantly across jurisdictions. Navigating this intricate landscape can be daunting, especially when family dynamics and emotional attachments are involved. Inheritance games, a term popularized by the young adult novel and Netflix series, refer to the complex web of relationships, secrets, and power struggles that often accompany wealth transfer. However, real-life inheritance situations can be even more complicated, with far-reaching consequences for all parties involved.

Inheritance laws and regulations aim to provide a framework for the distribution of assets after an individual's passing. While these laws offer some structure, they cannot account for the myriad personal, financial, and emotional factors that come into play when dealing with inherited wealth. As a result, inheritance situations can be fraught with tension, conflict, and unexpected twists, making them more complicated than the fictional "inheritance games" often depicted in popular culture.

The Complexity of Inheritance Laws

Inheritance laws vary significantly across jurisdictions, with different countries, states, and even cities having their own set of rules and regulations. For instance, some jurisdictions follow the principle of testamentary freedom, which allows individuals to distribute their assets as they see fit in their will. Others, like some European countries, have forced heirship laws that dictate how assets must be divided among family members.

Understanding these laws is crucial when navigating inheritance situations. Failure to comply with the relevant laws and regulations can result in costly legal battles, delays in the distribution of assets, and even the loss of inheritance. It is essential for individuals to seek professional advice from attorneys, financial advisors, or other experts familiar with the specific laws and regulations in their jurisdiction.

Types of Inheritance

There are several types of inheritance, each with its own set of rules and implications. Some common types of inheritance include:

- Testate Inheritance: When an individual leaves a valid will that outlines how their assets should be distributed after their passing.

- Intestate Inheritance: When an individual dies without a will, and the distribution of their assets is determined by the laws of their jurisdiction.

- Joint Inheritance: When two or more individuals inherit assets together, often with shared ownership and responsibilities.

- Trust Inheritance: When assets are placed in a trust, which is managed by a trustee for the benefit of the beneficiaries.

The Role of Family Dynamics in Inheritance

Family dynamics play a significant role in inheritance situations, with relationships, emotions, and personal biases often influencing the distribution of assets. In some cases, family members may have conflicting expectations or interests, leading to tension and conflict. It is essential for families to communicate openly and honestly about their wishes, expectations, and concerns to avoid misunderstandings and ensure a smoother inheritance process.

Common Family Dynamics in Inheritance

Some common family dynamics that can impact inheritance include:

- Sibling Rivalry: When siblings have competing interests or expectations regarding the distribution of assets.

- Parent-Child Conflict: When parents and children have differing opinions on how assets should be distributed or managed.

- Blended Families: When step-children, step-parents, or other blended family members are involved in the inheritance process.

- Family Business: When a family business is involved, and the inheritance process must consider the interests of multiple stakeholders.

Tax Implications of Inheritance

Inheritance can have significant tax implications, with beneficiaries potentially facing taxes on the assets they inherit. The tax implications of inheritance vary depending on the jurisdiction, the type of assets involved, and the relationship between the beneficiary and the deceased.

Common Tax Implications of Inheritance

Some common tax implications of inheritance include:

- Estate Taxes: Taxes levied on the estate of the deceased before assets are distributed to beneficiaries.

- Inheritance Taxes: Taxes levied on the beneficiaries of an estate, often based on the value of the assets they inherit.

- Capital Gains Taxes: Taxes levied on the sale of assets that have appreciated in value since the deceased's passing.

Best Practices for Navigating Inheritance

Navigating inheritance situations requires careful planning, communication, and professional advice. Some best practices for navigating inheritance include:

- Seek Professional Advice: Consult with attorneys, financial advisors, or other experts familiar with the relevant laws and regulations.

- Communicate Openly: Encourage open and honest communication among family members to avoid misunderstandings and ensure a smoother inheritance process.

- Plan Ahead: Consider estate planning strategies, such as wills, trusts, and powers of attorney, to ensure that assets are distributed according to one's wishes.

- Be Prepared: Educate oneself on the inheritance laws and regulations in one's jurisdiction, as well as the tax implications of inheritance.

As you can see, inheritance situations can be far more complex and nuanced than the fictional "inheritance games" often depicted in popular culture. By understanding the laws, regulations, and family dynamics involved, individuals can better navigate these situations and ensure that their wishes are respected. If you have any questions or concerns about inheritance, we encourage you to share them in the comments below.

What is the difference between testate and intestate inheritance?

+Testate inheritance occurs when an individual leaves a valid will that outlines how their assets should be distributed after their passing. Intestate inheritance, on the other hand, occurs when an individual dies without a will, and the distribution of their assets is determined by the laws of their jurisdiction.

How do taxes impact inheritance?

+Inheritance can have significant tax implications, with beneficiaries potentially facing taxes on the assets they inherit. The tax implications of inheritance vary depending on the jurisdiction, the type of assets involved, and the relationship between the beneficiary and the deceased.

What are some best practices for navigating inheritance?

+Some best practices for navigating inheritance include seeking professional advice, communicating openly with family members, planning ahead, and being prepared. It is essential to educate oneself on the inheritance laws and regulations in one's jurisdiction, as well as the tax implications of inheritance.